GIA

Structure

GIA Structure, LLC is a professional services firm, that specializes in providing financial structuring support for infrastructure projects looking to apply for investment funds. Our team of experts handles all the transaction structuring work, delivering world-class offering documents and supporting documentation to feature the transaction to prospect investors, lenders and risk underwriters. It subsequently facilitates the diligence processes, assisting in the lending, investing and risk underwriting decisions. With GIA Structure, LLC clients can save time and resources while ensuring that their applications are well-prepared and meet the necessary criteria Including due diligence, compliance, and legal documentation for the right investment.

Navigating the Path to Successful Infrastructure Financing

GIA Structure plays a crucial role in offering extensive financial structuring assistance for infrastructure initiatives. This highlights their proficiency in drafting vital financial documents, performing in-depth evaluations, and streamlining the investment journey, all of which are key elements in the success of financing infrastructure projects.

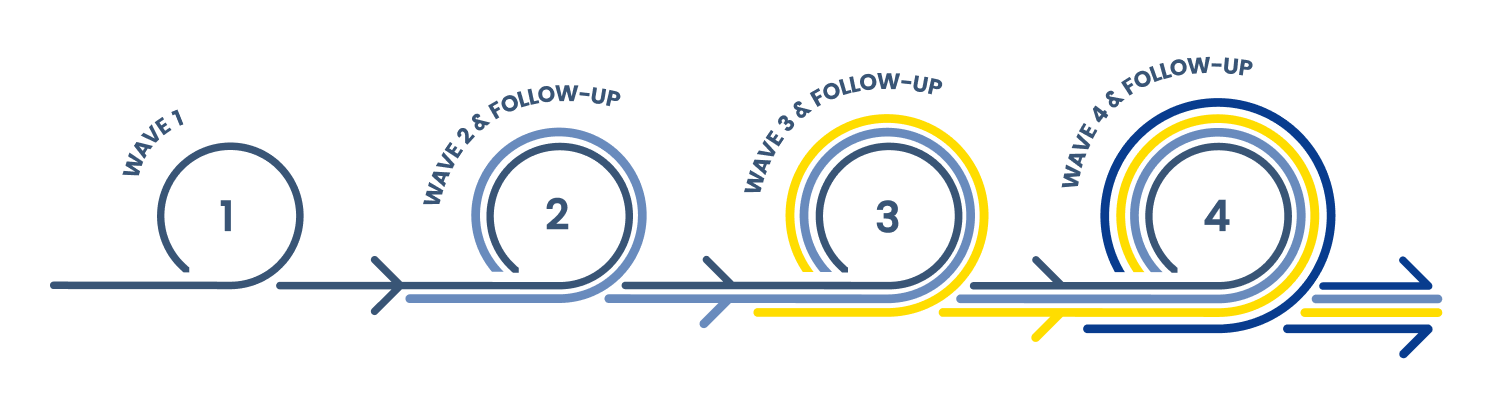

Our Process

GIA Structure, LLC prepares a financial analysis of the project and produces all the Offering Documents required to feature the transaction to prospect risk underwriters, lenders, and investors. The end result is an electronic data room which will be used to conduct a competitive process in the global debt and capital markets.

Learn more

Offering Documents

1. Business Plan Development

We craft comprehensive business plans that delineate a project's goals, strategies, market analysis, and financial projections. These documents offer a thorough overview of the business, encapsulating its objectives, target audience, and competitive edge.

2. Financial Modeling

We craft tailored financial models for project forecasts. Our custom tools use advanced spreadsheets to predict income, balance, and cash flow.

3. Cash Flow Analysis

Our team prepares detailed cash flow analysis reports that track the cash inflows and outflows of a project. This analysis is crucial for identifying potential liquidity shortfalls and ensuring the project's financial health.

4. Executive Summary Preparation

We create succinct executive summaries that highlight key points of the business plan, including the project’s mission, target market, unique selling proposition, financial projections, and management team.

5. Comprehensive Assessment

GIA’s comprehensive assessment exercise involves an exhaustive evaluation of the project's financial performance, operations, and management team. It aids in identifying strengths and weaknesses, serving as a critical guide for strategic decision-making.

6. Management Presentation

GIA’s comprehensive assessment exercise involves an exhaustive evaluation of the project's financial performance, operations, and management team. It aids in identifying strengths and weaknesses, serving as a critical guide for strategic decision-making.

7. Ideal Terms Sheet

Our team creates project Terms and Conditions to secure 100% of needed funding. We present these to potential investors through a competitive process. The Ideal Term Sheet maximizes Internal Rate of Return (IRR) by optimizing capital structure.

Supporting Documentation

Organizational

This section holds all documentation about the company's structure and management. It covers articles of incorporation, bylaws, organizational charts, executive qualifications, shareholder agreements, stock issuance, ownership, board meeting minutes, and key governance details.

Financial

In the financial section, you'll find extensive documentation on the company's financial well-being. This encompasses historical financial statements (income, balance, cash flow), audited reports, tax returns, future performance forecasts, and capital expenditure plans for at least three to five years.

Commercial

In the commercial section, we provide an extensive overview of the company's market, encompassing market research, marketing strategies, customer data, key customer details, contracts, suppliers, partnerships, product or service information, pricing strategies, and sales channels.

Technical

This section delves into the business's technology domain, covering patents, copyrights, trademarks, proprietary technology, IT infrastructure, software, hardware, and any technical vulnerabilities or IT-related risks.

Legal

The legal section comprises documents concerning past, present, and potential future legal matters. This includes ongoing litigation, judgments, settlements, regulatory compliance reports, and various legal agreements like employment, leasing, licensing, and confidentiality agreements.

Regulatory

In the regulatory section, you'll find documents showcasing the company's adherence to regulatory requirements. This encompasses permits, licenses, compliance reports, regulatory correspondence, and, for broker-dealers, FINRA or SEC registration, compliance policies, and records of regulatory reviews and actions.

Risk Managment

This section encompasses comprehensive risk management, including risk identification, assessment, and mitigation strategies. It covers insurance policies, health and safety protocols, disaster recovery, business continuity plans, and other relevant risk management strategies.

ESG

The ESG (Environmental, Social, Governance) section details the company's strategies and performance in these areas, encompassing sustainability policies, waste management, energy use reports, social policies on human rights, labor practices, community engagement, governance aspects like board diversity, executive pay, and shareholder rights.

GIA's Investor Relations Approach

Our Investor Relations' approach stems from the combination of five crucial elements, providing valuable insights to our investors, fostering trust, and ensuring our project's long-term prosperity.

Access to Capital

Our extensive access to diverse capital sources and our proprietary risk appetite mapping enables us to target the most appropriate funding sources for each project.

Dual Curation

We employ a dual curation process of capital providers and contacts, facilitating engagement with the most pertinent decision-makers within relevant entities.

Industry Expertise

We possess a deep understanding of capital providers' and insurance carriers' decision-making processes, optimizing the path to financial closing.

Proprietary Process

Our uniquely developed process is rooted in profound expertise in business intelligence and extensive experience with capital and insurance markets.

Resilience

Our soliciting campaigns are adaptable, dynamic, and flexible, determining whom to contact, when, and how, while being able to expand, concentrate, and reshape the roster as needed.

Campaign Focus

Our soliciting campaigns are dynamic and continually evolve based on our diligent research and feedback from the capital and insurance markets.

Get Started

Our clients are our passion! We’re here to help you with any questions you might have. We can’t wait to hear from you!